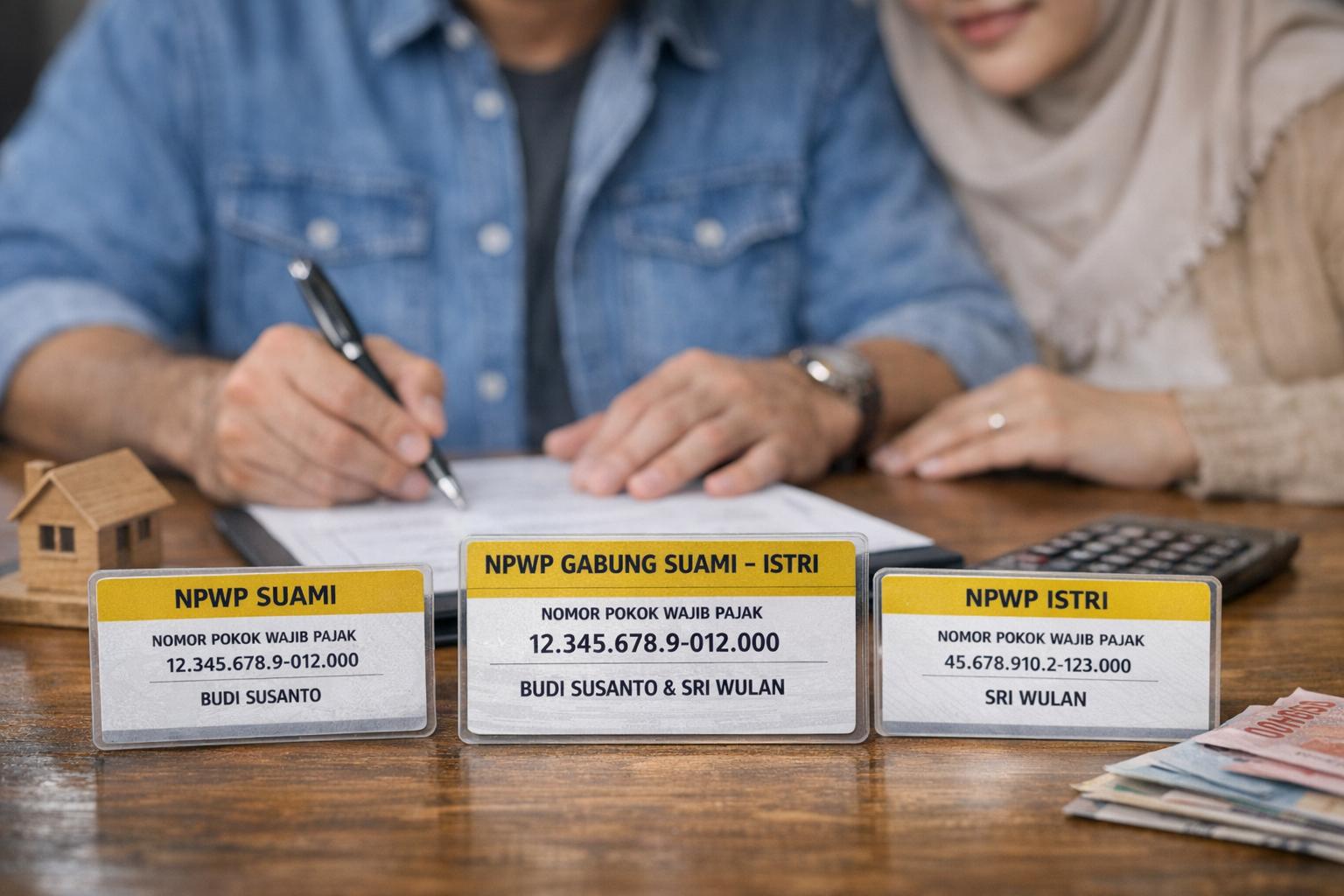

The topic of joint NPWP (NPWP gabung suami–istri) has recently become a major point of discussion among Indonesian taxpayers. With the rollout of the Coretax Administration System, many married couples suddenly found their tax identities linked or merged automatically. This led to confusion about who should file the SPT, which NPWP should be used, and whether a wife must use her husband’s tax ID.

This article explains why the issue has gained so much attention, clarifies the legal framework behind joint and separate taxation, and outlines how married couples can navigate their SPT filing in the Coretax era.

1. Why Is “NPWP Gabung Suami–Istri” Trending?

As stated in the document:

“Indonesian social media and news outlets have been buzzing about the rules for joint NPWP…”

The public discussion centers on several key questions:

- Is the husband’s NPWP automatically the primary tax identity?

- Is the wife’s NPWP being merged or linked?

- Must a wife use her husband’s NPWP?

- How should couples file SPT if both earn income?

Coretax enforces stricter identity integration, which made many taxpayers realize their NPWP or NIK data was being linked automatically—triggering widespread debate, especially among dual-income households.

2. Legal Basis: Joint vs Separate Taxation

The document explains:

“A married woman’s tax obligations can be combined with her husband’s (default system), or separated…”

A. Joint Filing (Default System)

Under the default tax regime:

- The husband’s NPWP becomes the primary tax ID

- The wife’s income is reported under the husband’s SPT

- Only one SPT is filed for the household

This system applies automatically unless the couple formally opts out.

B. Separate Filing (Pisah Harta / Separate Tax Rights)

If the wife chooses to maintain her own tax rights:

- She uses her own NPWP/NIK

- She files her own SPT

- Her income is taxed separately

- A formal declaration must be submitted to the tax office

This option is commonly chosen by dual-income couples who prefer financial independence.

3. Why the Public Reaction?

The document notes:

“The sudden enforcement of identity integration in Coretax led many to believe…”

Many taxpayers assumed:

- Women were being forced to use their husband’s NPWP

- Their personal NPWP was being “deleted”

- They could no longer file independently

In reality, the legal framework has not changed.

Coretax simply applies the rules more consistently, but the lack of clear communication created confusion and sparked public debate.

4. How Married Couples Should File SPT in Coretax

1. Determine Your Taxation System

Decide whether you are filing jointly or separately.

2. Ensure Your Status Matches the System

Check whether Coretax reflects your chosen marital tax status correctly.

3. If Filing Separately

Ensure your declaration of separate tax rights has been approved by the tax office.

4. If Filing Jointly

Ensure all income—including the wife’s—is reported in the husband’s SPT.

5. Internal Linking Recommendation

For readers who want to understand how Coretax affects SPT filing in general:

Read also: Understanding Indonesia’s Annual Individual Tax Return (SPT Tahunan)